does doordash report income to irs

If you dont file taxes voluntarily the IRS will eventually catch up to you. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021.

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

However if you submit your tax forms you may be required to return unemployment compensation.

. If you overpaid at the end of the year you will get some money. DoorDash does not provide a breakdown of your total earnings between base pay tips pay boosts milestones etc. Federal income taxes apply to Doordash tips unless their total amounts are below 20.

Log into your checking account every pay day and put at least 25 of your dd earnings in savings. The forms are filed with the US. In most situations part-time DoorDash drivers can still be on unemployment.

Yes - Cash and non-cash tips are both taxed by the IRS. Although some DoorDash payouts are not reported to the government all drivers are provided with a 1099 so they will become aware at the end of the tax year. In simple terms whether you sell a stock or receive a dividend you need to report everything in your income tax.

This sounds like a real drag but actually its a blessing in disguise. Internal Revenue Service IRS and if required state tax departments. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

However Doordash issues a 1099 form at the end of each tax year if you make more than 600 and reports your income as an independent contractor expense. When you open an account with Webull or any other brokerage youll be asked to provide your Social Security number or taxpayer identification number. Instead Dashers are paid in full for their work and must report their DoorDash pay to the IRS and pay taxes themselves when it comes time.

Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC. However you still need to report them. You need to carefully review form 1099 from TradeStation and report any Option Trading on your Tax Return.

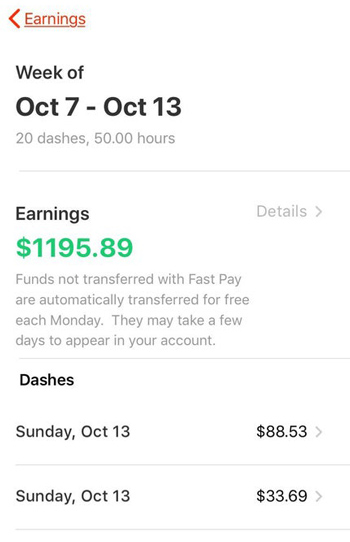

It will look something like this. It may not be in the first year but youll eventually have to pay. What is reported on the 1099-K.

Your cash tips are not included in the information on the 1099-NEC you receive from Doordash. Log into your checking account every pay day and put at. Dashers should make estimated tax payments each quarter.

Answer 1 of 5. This allows the brokerage to track your investment. Doordash will send you a 1099-NEC form to report income you made working with the company.

Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly. At the end of every quarter add up your income for the quarter and pay at least 25 of that online to the govt. You do have the obligation to report any income to the IRS regardless of whether a 1099 was sent to you -- assuming you made at least 12550 total as a single taxpayer etc.

The short answer is yes Webull does report the investor information to the IRS. If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes. Since you did not file your expenses and miles which would reduce your tax bill it wouldnt be surprising if you were ultimately char.

They have no obligation to report your earnings of. DoorDash does not automatically withhold taxes. Per IRS guidelines Gross Volume processed via the TPSO which in DoorDashs case is the Subtotal and Tax on orders processed.

A 1099-NECyoull receive this from DoorDash if you received at least. No because Dashers are not employees DoorDash does not withhold FICA taxes from their paycheck. Does DoorDash report to IRS.

A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. You do not get quarterly earnings reports from dd. The most important box on this form that youll need to use is Box 7 Nonemployee Compensation.

If you wait until April to pay you could have to pay a penalty if you owe more than 1000. Yes TradeStation not only report Stocks Dividends Crypto they also report any Options Trading to the IRS. If youre a Dasher youll need this form to file your taxes.

In fact all brokerages are required by law to do so. In 2020 the IRS has mandated that DoorDash report Dasher income on the new Form 1099-NEC rather than the Form 1099-MISC. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

DoorDash does not take out withholding tax for you. Typically you will receive your 1099 form before January 31 2022. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

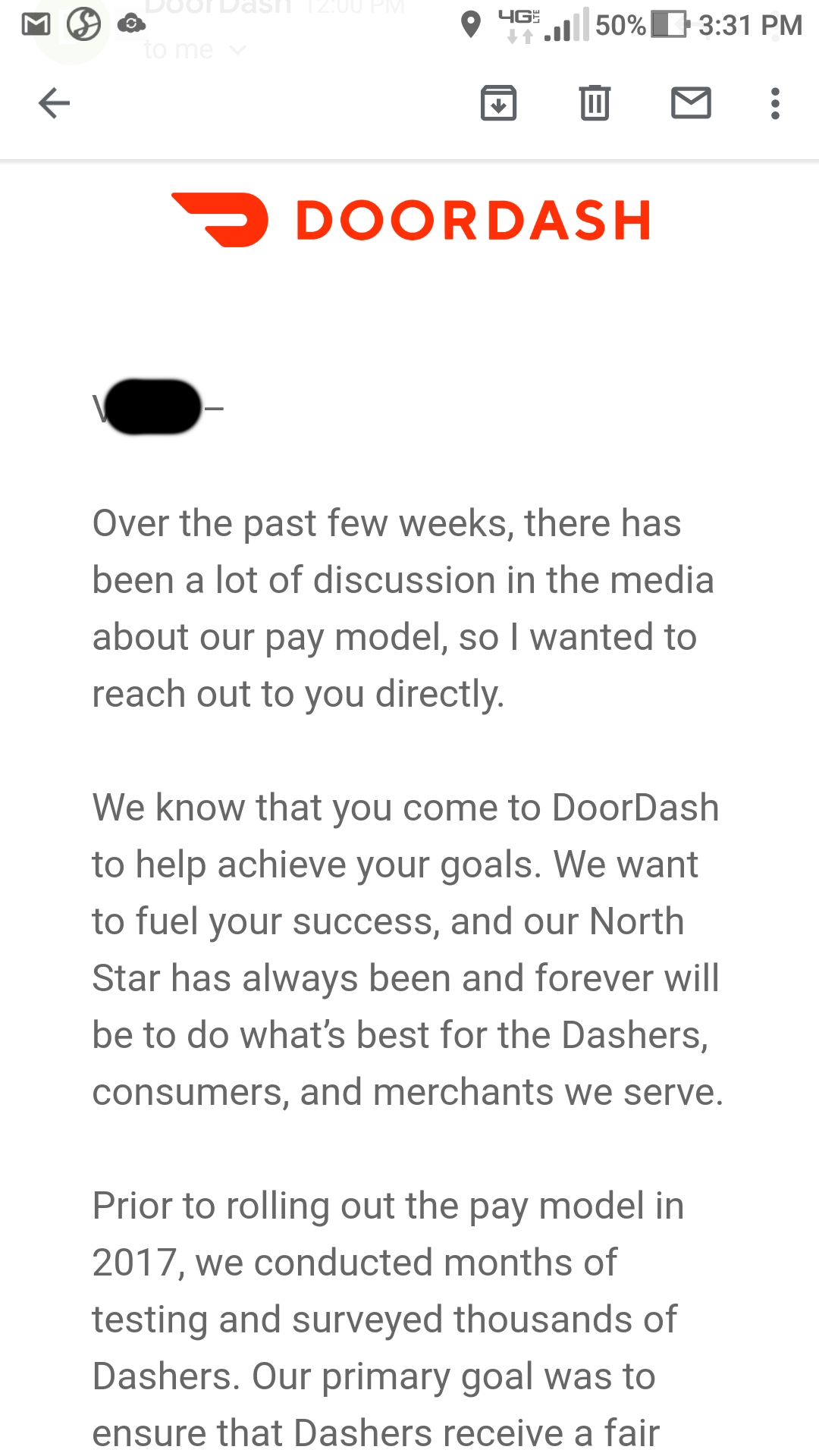

Oops Doordash Ceo Suggests The Company Pays The Equivalent Of Less Than 6 Hour Payup

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

A Beginner S Guide To Filing Doordash Taxes 4 Steps

2022 Data How Much Doordash Drivers Actually Make Ridesharing Driver

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Doordash Tax Guide What Deductions Can Drivers Take Picnic S Blog

15 Must Know Doordash Driver Tips 2022 Make More As A Dasher

How Much Does Doordash Pay Dailyworkhorse Com

Oops Doordash Ceo Suggests The Company Pays The Equivalent Of Less Than 6 Hour Payup

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com